What is a cap rate?

12/14/2017 (Updated 12/20/2017)

A Market Capitalization Rate, or “Cap Rate” is an investor’s expected yearly yield of Net Operating Income on the total purchase price of an investment property expressed as a percentage. It is market derived because the laws of supply & demand dictate the rates that an investor can expect to receive from a given property type in any given location.

For Example: If an office building in Atlanta is priced at $1,000,000 and it generates $50,000 in Net Operating Income per year, the property has a “Cap Rate” of 5%. Unless the seller or property’s situation is incredibly unique, due to supply and demand it can also be inferred that most office buildings in Atlanta will trade at a similar cap rate of 5%.

The real estate market itself will dictate the cap rate that an investor can expect to receive from an investment in any specific type of property or location. Cap rates will always reflect risk and demand in any market or submarket.

The Cap Rate assumes that an investor always pays cash for Real Estate (even if in reality they don’t). The cap rate does not take into account the total amount invested in the property through the use of leverage. Leverage can certainly amplify profits on real estate investments, but it has no bearing on cap rates.

This is important because it allows you to easily compare the yield on different properties by analyzing their cap rates.

Cap Rates VS Discount Rates

A lot of people confuse Market Capitalization Rates (Cap rates) with an Investor’s Discount Rate.

An Investor’s Discount Rate is simply the yield that an investor WANTS to make from a given purchase price. This is only possible if an investor’s discount rate matches current market cap rates.

For Example: Bob desires a yield of 10% on a $1,000,000 purchase price for an Apartment Building in Los Angeles. Bob finds that properties priced around $1,000,000 in Los Angeles are generating about $30,000 in Net Operating Income. He has now learned that the Market Cap Rate for Apartment buildings in Los Angeles is 3%. Bob has to decide to invest at that rate or possibly find a different area or type of property.

As we have learned, a cap rate is not chosen by the investor. It is dictated by supply and demand.

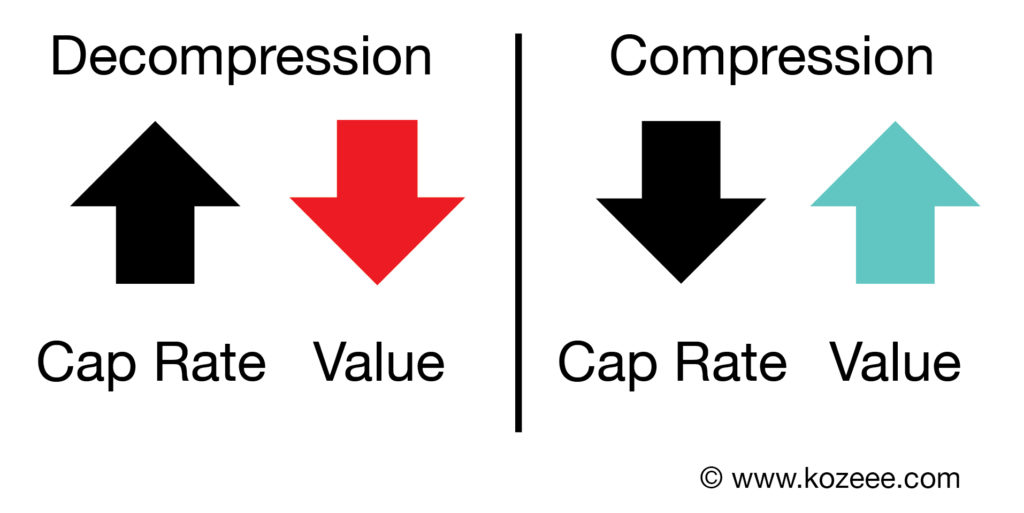

It is important to understand that when Cap Rates go UP – prices go DOWN, and vice-versa.

Think about it- if an investor is going to make 10% from a property’s rent, they must buy it cheaper than if they were to make 5% off of the same rent!

Cap Rates fluctuate with the economy and real estate cycle.

- When cap rates are going UP they are said to be “Decompressing”

– This is the phase of the real estate cycle when prices are going DOWN.

- When cap rates are going DOWN, they are said to be “Compressing”

– This is the phase of the real estate cycle when prices are going UP.

This is why current cap rates form a major part of what your property is worth. As of now, in December 2017, Cap rates are extremely low historically. That means values are HIGH and NOW is a great time to sell your commercial property!

Find an expert in current cap rates in your area. Click here and we will refer you to a licensed, qualified & experienced agent that can help you sell your property anywhere in the USA.