How much is my commercial property or apartment building worth?

12/14/2017 (Updated 06/06/2018)

In this article we will teach you how real estate agents and potential buyers (investors) use what is called the Income Valuation Approach to figure out how much your commercial property or apartment building is worth. The experienced commercial specialist we will refer to you will use this technique when evaluating how much your property is worth.

The Income Valuation Approach, also known as The Income Approach to Value is used by experts to value apartment buildings, office buildings, industrial buildings, single tenant net leased properties, duplexes, triplexes, medical buildings and all types of retail properties.

You must use this technique whenever you sell or purchase rental properties or you are just making wild guesses.

Despite what some websites may try and lead you to believe, the ONLY way to arrive at the investment value, and thus the market value of your commercial real estate is for you and your agent to use the income valuation approach!

The Three Elements of Value

There are three elements in the Income Valuation Approach. The great part is that if you know two of them, you can always figure out the other one! However, The focus of this article is determining how much your property is worth, so we will focus on that.

The three elements of Value are:

- I. INCOME (Net Operating Income)

- R. RATE (Market Capitalization Rate)

- V. VALUE (Price on the open market)

To calculate the value, you just need to know the first two:

- The Net Operating Income of the property (NOI) &

- The Market Capitalization Rate (Cap Rate)

We also call this the IRV formula, as you can see it is not because it was created by a guy named Irv!

What are Cap Rates & NOI?

Net Operating Income (also known as NOI) is the gross operating income of the property less any operating expenses.

You can learn how to calculate Net Operating Income here. It is extremely important to understand this concept if you want to arrive at an accurate value.

A Market Capitalization Rate, or “Cap Rate” is an investor’s expected yearly yield of Net Operating Income on the total purchase price of an investment property expressed as a percentage. It is market derived because the laws of supply & demand dictate the rates that an investor can expect to receive from a given property type in any given location.

You can learn more about Cap Rates here. It is extremely important to understand this concept if you want to arrive at an accurate value.

So How Much is my Commercial Property Worth?

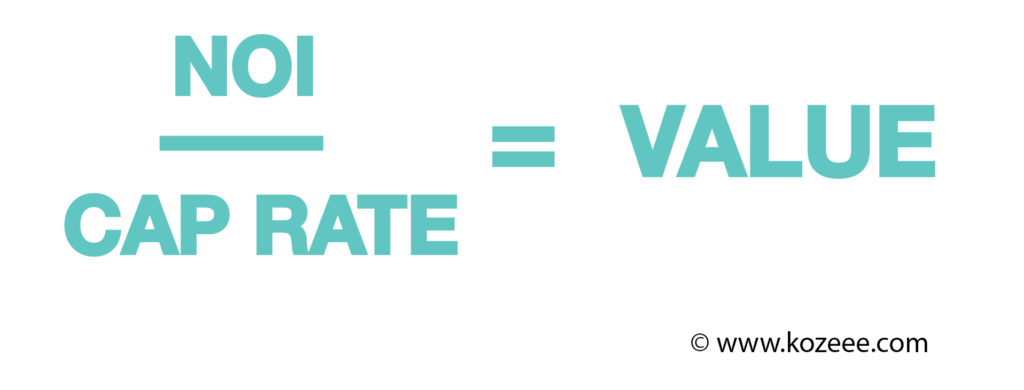

The IRV Formula

Income (÷) Rate (=) Value

Simply divide your NOI by the Market Cap Rate and you get the value of your commercial property!

There you have it, the correct way to figure out how much your commercial or multi-family property is worth! It may seem complex at first, and it is. We don’t expect you to be experts at this, that is what a great agent is for! Let us refer you to an expert now!

Click here and we will refer you to a licensed, qualified & experienced agent that can help you sell your property anywhere in the USA.